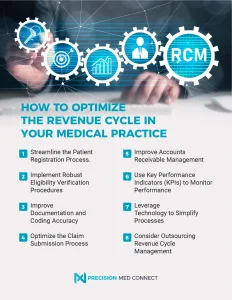

Maintaining financial stability in a medical practice requires optimize the revenue cycle management. The revenue cycle includes all administrative and clinical operations that help record, manage, and collect income from patient services. Every stage, from booking appointments to collecting payments, has a direct impact on your practice’s cash flow. In this post, we’ll go over essential tactics for optimizing your revenue cycle, with an emphasis on improving billing processes and accounts receivable management to maintain continuous cash flow, reduce claim denials, and improve financial performance.

1. Streamline the Patient Registration Process

The foundation of a smooth revenue cycle begins at patient registration. Accurate and complete information collected at this stage is vital for successful billing. Ensure that your staff verifies and updates patient information regularly, including insurance details, contact information, and any necessary authorizations.

Automating parts of the registration process can also reduce human error and improve efficiency. For example, using electronic forms that patients can fill out before their visit helps minimize mistakes and speeds up the check-in process. This step alone can significantly reduce delays in billing and improve the likelihood of full reimbursement.

2. Implement Robust Eligibility Verification Procedures

Insurance eligibility verification is a critical step that should occur before any patient is seen by a healthcare provider. By confirming a patient’s insurance coverage and benefits beforehand, your practice can avoid claim denials and unexpected costs for the patient.

Utilize automated tools to check eligibility in real-time. This not only saves time but also ensures accuracy. Additionally, training your staff to understand different insurance plans and benefits will help them address any issues or discrepancies before they escalate into larger problems.

3. Enhance Documentation and Coding Accuracy

Accurate documentation and coding are essential for maximizing reimbursement and avoiding claim denials. Ensure that your medical providers are well-versed in the latest coding practices, including ICD-10, CPT, and HCPCS codes. Regular training and updates on coding changes can help prevent errors that lead to denials.

Consider investing in medical billing software that includes built-in coding assistance. This can help your practice identify the correct codes and reduce the time spent on manual entry. Additionally, conducting regular audits of your documentation and coding processes can identify areas for improvement and ensure compliance with industry standards.

4. Optimize the Claim Submission Process

Timely and accurate claim submission is crucial for maintaining a healthy cash flow. Submitting claims electronically is the most efficient way to ensure they are processed quickly. Make sure your billing team is trained to submit clean claims—those that are complete and accurate—on the first try.

Implement a system to track the status of submitted claims. This allows your team to quickly identify and resolve any issues that arise during the processing stage. Using a claims management system that integrates with your electronic health record (EHR) can further streamline this process and reduce the chances of errors.

5. Improve Accounts Receivable Management

Effective AR management is essential to ensure that your practice receives payment for services rendered. Start by establishing clear policies for payment collection, including copays and deductibles, at the time of service. Patients should be informed of their financial responsibilities upfront, which can reduce the likelihood of unpaid bills.

Monitor your AR regularly to identify outstanding accounts and take prompt action on overdue payments. Consider implementing a system that automatically generates follow-up reminders for unpaid balances. If necessary, work with patients to set up payment plans that accommodate their financial situation while ensuring your practice receives timely payments.

Outsourcing AR management to a specialized service provider can also be a valuable option, particularly for practices with limited administrative staff. These providers have the expertise and resources to follow up on outstanding claims and payments, often resulting in faster collections and improved cash flow.

6. Use Key Performance Indicators (KPIs) to Monitor Performance

Monitoring KPIs is essential for evaluating the effectiveness of your revenue cycle management (RCM) processes. Some important KPIs to track include:

Days in Accounts Receivable: This metric measures the average number of days it takes to collect payments. A lower number indicates more efficient collections.

Net Collection Rate: This reflects the percentage of payments collected out of the total amount billed, indicating how effective your practice is at capturing revenue.

Denial Rate: Monitoring the percentage of claims denied by payers can help identify issues in your billing and coding processes.

By regularly reviewing these KPIs, you can identify trends, pinpoint problem areas, and make data-driven decisions to improve your revenue cycle.

7. Leverage Technology to Streamline Processes

Technology plays a significant role in optimizing the revenue cycle. Medical billing software, practice management systems, and EHRs can all help streamline processes, reduce errors, and improve overall efficiency. These tools can automate tasks such as eligibility verification, claim submission, and payment posting, freeing up your staff to focus on more complex tasks.

Additionally, consider using analytics tools to gain insights into your revenue cycle performance. These tools can help you identify patterns, forecast cash flow, and make informed decisions about where to invest resources for the greatest impact.

8. Consider Outsourcing Revenue Cycle Management

Outsourcing revenue cycle management to a trusted partner like Precision Med Connect can provide significant benefits, especially for smaller practices with limited resources. Professional RCM services bring specialized expertise and technology to handle billing, coding, AR management, and more. This allows your practice to focus on patient care while ensuring that revenue cycle processes are handled efficiently and effectively.

Outsourcing can also lead to cost savings by reducing the need for in-house billing staff and technology investments. Additionally, RCM providers are often better equipped to keep up with industry changes and compliance requirements, reducing the risk of errors and penalties.

Conclusion

Optimizing the revenue cycle is critical to the financial health of your medical practice. By expediting patient registration, improving documentation and coding accuracy, optimizing AR management, and using technology, you can maintain consistent cash flow and reduce the chance of claim denials. Monitoring KPIs and contemplating outsourcing RCM services can help your practice run more efficiently and profitably.

Taking proactive actions to optimize your revenue cycle management benefits your practice financially while also allowing you to focus more on what is most important—providing exceptional treatment to your patients.

If you want to further improve the efficiency of your practice, fill out our form today and receive a free analysis to discover how to optimize your revenue cycle and strengthen your practice’s financial performance.